Michis FAQ

-

Can I pay flights directly through my grant?

Yes, this is possible by booking through our contact at Columbus.

He needs the following information:

- info on airports and dates

- name of the passenger and, if possible, copy of passport (to make sure there's no spelling mistakes)

- e-mail address and phone number of the passenger

- internal order number of your grant

To get in touch with him, please contact Michael Dorninger

-

How can I pay invoices directly through my grant?

To pay costs directly through the grant, the invoicing party has to send the invoice as a pdf (being the only attachment) to rechnung@univie.ac.at

The billing address has to be:

Universität Wien

Finanzwesen und Controlling

xxxx*

Universitätsring 1

1010 Wien* xxxx being your grant number

-

Can I combine a work trip with a private stay/holiday?

Yes! If the private stay takes place at the same location, reimbursement should be straightforward and will likely not cause any issues.

If you travel to/from another location, things might get trickier as Personnel/Finance will deduct a certain amount of the flight price.

See here for details or contact Michael.For the travel request, only choose the dates of the work related part.

-

Can I use my FWF grant to buy equipment such as a laptop?

Using an FWF grant to buy equipment or laptops is only possible in special circumstances.

FWF states that "[f]unding for equipment may only be requested if the equipment is specifically required for the project and if it is not part of the institution’s existing infrastructure. "Infrastructure" is considered to include all equipment (and components for the equipment) that must be available in a modern research institution to conduct basic research in the relevant discipline at an internationally competitive level. Thus, items such as computers (laptops, etc.) are considered to be part of the standard infrastructure and therefore no funding will be approved for these items."

-

Are there maximum amounts for travel and accomodation costs?

Accomodation costs can be reimbursed up to 9x the nightly allowance you can claim for the specific destination.

For travel costs, no maximum amounts exist, but usually 1st class/business class tickets cannot be reimbursed - only in special circumstances. Taxi costs should be avoided wherever possible.

-

Can I ask for a travel subsidy?

In theory, subsidies (Reisekostenzuschuss) can also be requested in projects. In practice, asking for compensation through the app "Reimbursements" is almost always the better choice. There, you can claim the same kind of receipts and the app is easier to navigate.

-

Can I ask for a travel advance?

Yes. If your travel costs exceed € 500,- you can ask for an advance payment (Reisekostenvorschuss) for your spendings. (€ 500,- is also the payment's minimum amount.)

In this case, the travel request has to be submitted and approved at least one month before the trip. Furthermore, reimbursement must happen through the app "Travel accounting" afterwards.

Travel advances are not possible when filing a Leave of Absence.

-

Who is responsible for my time and travel management?

Please click on the links below to find your contact persons:

-

Where can I find help with the online forms?

Here's some ➥quick guides with pictures for the online forms:

- Travel request

- Travel accounting (allowances and approved travel request)

- Reimbursement of travel costs (no allowances)

- Reimbursement of material costs/online conference fees

If you have any further questions, please contact Michael Dorninger.

-

Which form should I use for reimbursements of material costs and online conference fees?

Please go to HR&FI services and use the app „Reimbursements“.

-

Should I take a train or a plane?

This is still up to you. However, if your project has overheads, 20% of a flight’s price (min. € 50, max. € 150 ) will be deducted additionally by the overheads as a climate compensation. Please refer to the university's Nachhaltigkeitsrichtlinie.

In FWF projects, voluntary compensations can be reimbursed up to 15% of a flight's price.

If you decide to take a train, hotel stays on longer voyages can be reimbursed, as well as tickets for couchettes or sleeping cars.

The Austrian Klimaticket itself is unfortunately non-refundable. Instead, transportation allowance or the surcharge to a 1st class ticket can be reimbursed

-

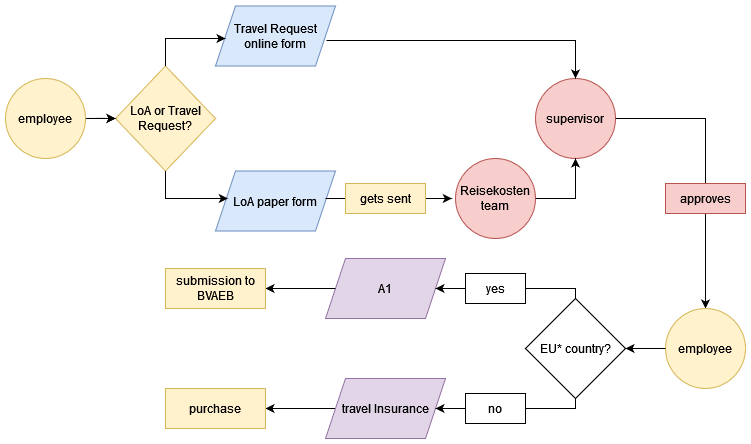

Which form do I need to fill out before going on a work trip?

When travelling to any place outside of Vienna, either a Leave of Absence/Freistellung or a Travel Request/Reiseantrag has to be filed.

Leave of Absence:

- the employee wants to travel

- deadline: two weeks before the trip*

- reimbursement of receipts (no food in FWF projects)

- form: PA/F7

- mandatory if the employee receives income from the host institution

Travel Request:

- the employee has to travel

- deadline: depends on project leader/Dean's office*

- reimbursement of receipts and allowances (per diems, kilometre allowance for car and train)

- online: HR&FI services -> Travel requests

A1 form:

If you are travelling to EU countries (other than Germany) or to Iceland, Liechtenstein, Norway, Switzerland or the UK, you also have to file a request for an „A1-Bescheinigung“ with BVAEB.

When filing a travel request, the system guides you through it: You'll receive info on the procedure in the approval e-mail.

Additionally, please add the following info in the field "note for trip" directly in the travel request:

- name of host organisation

- address abroad (e.g. hotel)

- the phrase "I hereby confirm that no income will be received from third parties during the business trip."

When applying for a leave of absence, please send the signed form to zwischenstaatliche.sv@bvaeb.at with the subject line "A1-Antrag für xxx" - xxx being your 10-digit social security number.

*The A1-Bescheinigung should be requested one month before the trip.

If any questions remain, please contact Michael Dorninger.

-

Is my hotel, insurance etc. taxable or non-taxable?

In most cases hotels, etc are non-taxable. Invoices only have to be taxed if the employee gained a private advantage from a work trip. (E.g. a travel insurance for a whole year that can be used for private trips.)

You can always ask Michael if you're not sure!

-

What are the daily and overnight allowances?

-

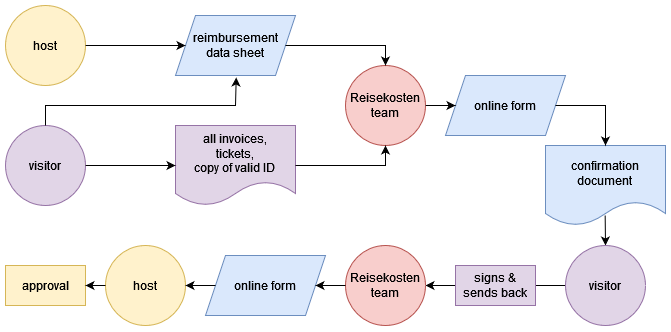

How can I refund a guest‘s travel expenses?

In most projects, guests can be reimbursed for receipts/invoices only. Taxi costs are usually non-refundable, neither is food.

Please use the Faculty’s ➥reimbursement data sheet and send it digitally filled to Michael Dorninger or to reisekosten.mathematik@univie.ac.at.

On the sheet, you find further instructions and info on which documents to attach.

You can find detailed instructions in German also in ➥[u:wiki].

-

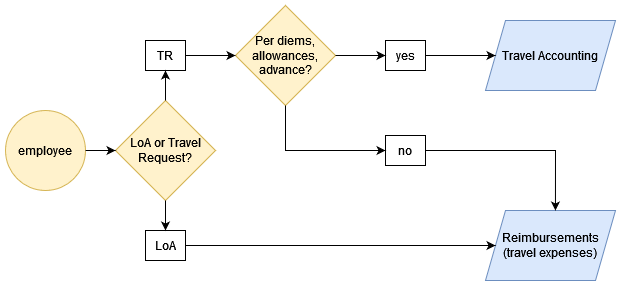

How can I refund my travel expenses?

Reimbursements are done online via the HR&FI services. Under „Invoices, Travel & Financial Reports“ choose either „Reimbursements“ or „Travel Accounting“.

- only receipts (no food in FWF projects)

- requested documents: receipts/invoices, train tickets – booking confirmations do not suffice!

- also possible without travel request

- possible until the end of next calendar year

- receipts and allowances (per diems, kilometre allowance for car and train)

- requested documents: receipts/invoices, tickets, boarding passes, payment confirmations – booking confirmations do not suffice!

- travel request needed

- when an advance payment has been requested or a taxable receipt shall be reimbursed

- possible until 6 months after the trip (or the end of employment if that's sooner) - note that the month you're travelling in already counts as month #1!

-

Do I need any special travel insurance on my business trip outside EU?

Yes! It could be though that you already have additional insurance through a credit card or something similar - please check. Another option is HanseMerkur.

Organizing a cancellation insurance is also advised and can be covered in most projects, e.g. those from FWF.