| ❮❮❮ |

|---|

budget

-

Can I pay flights directly through my grant?

Yes, this is possible by booking through our contact at Columbus.

He needs the following information:

- info on airports and dates

- name of the passenger and, if possible, copy of passport (to make sure there's no spelling mistakes)

- e-mail address and phone number of the passenger

- internal order number of your grant

To get in touch with him, please contact Michael Dorninger

-

How can I pay invoices directly through my grant?

To pay costs directly through the grant, the invoicing party has to send the invoice as a pdf (being the only attachment) to rechnung@univie.ac.at

The billing address has to be:

Universität Wien

Finanzwesen und Controlling

xxxx*

Universitätsring 1

1010 Wien* xxxx being your grant number

-

Can I use my FWF grant to buy equipment such as a laptop?

Using an FWF grant to buy equipment or laptops is only possible in special circumstances.

FWF states that "[f]unding for equipment may only be requested if the equipment is specifically required for the project and if it is not part of the institution’s existing infrastructure. "Infrastructure" is considered to include all equipment (and components for the equipment) that must be available in a modern research institution to conduct basic research in the relevant discipline at an internationally competitive level. Thus, items such as computers (laptops, etc.) are considered to be part of the standard infrastructure and therefore no funding will be approved for these items."

-

Are there maximum amounts for travel and accomodation costs?

Accomodation costs can be reimbursed up to 9x the nightly allowance you can claim for the specific destination.

For travel costs, no maximum amounts exist, but usually 1st class/business class tickets cannot be reimbursed - only in special circumstances. Taxi costs should be avoided wherever possible.

-

How do I acknowledge the FWF in my publications?

The following rules apply to all publications resulting from an FWF project:

Acknowledging the FWF using the Grant-DOI:

The following text must be included in all peer-reviewed publications (e.g., journal articles) upon submission:This research was funded in whole or in part by the Austrian Science Fund (FWF) [grant DOI]. For open access purposes, the author has applied a CC BY public copyright license to any author-accepted manuscript version arising from this submission.

see ➥https://www.fwf.ac.at/en/funding/steps-to-your-fwf-project/carrying-out-your-project

The [grand DOI]-number of your project you can find here:

➥https://www.fwf.ac.at/en/discover/research-radar -

Can I ask for a travel subsidy?

In theory, subsidies (Reisekostenzuschuss) can also be requested in projects. In practice, asking for compensation through the app "Reimbursements" is almost always the better choice. There, you can claim the same kind of receipts and the app is easier to navigate.

-

How can I finance the costs of Open Access publications?

The following new regulation has applied since 1.1.2024:

- There exists an OA agreement with the University of Vienna ➨ There is no need to apply for funding with the Open Access Office since Open Access can be ordered directly as part of the publishing process. (@univie.ac.at e-mail address must be used with the submission of the article)

- There exists no OA agreement with the University of Vienna ➨ You can apply for funding for article processing charges (APCs) for individual articles in Open Access journals. To apply for Open Access funding please fill in the ➥OA‑Application Form UNIVIE or the ➥OA Application Form FWF (for FWF-projects). Apply before submission to ensure that the charges can be covered.

Use the ➥Journal Eligibility Check to find out if OA publishing in your desired journal can be centrally funded via publishing agreements or if a funding application is required.

Important notes:

Please do not pay invoices yourself (e.g. using your private credit card) – refunds are not possible! For FWF projects please include following text in your publication: "This research was funded in whole or in part by the Austrian Science Fund (FWF) [grant DOI]. For open access purposes, the author has applied a CC BY public copyright license to any author accepted manuscript version arising from this submission."

➥ Starting in 2024: New process for FWF OA funding

[publications open research fwf

-

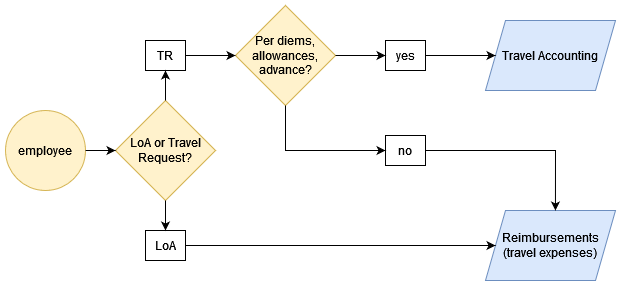

Can I ask for a travel advance?

Yes. If your travel costs exceed € 500,- you can ask for an advance payment (Reisekostenvorschuss) for your spendings. (€ 500,- is also the payment's minimum amount.)

In this case, the travel request has to be submitted and approved at least one month before the trip. Furthermore, reimbursement must happen through the app "Travel accounting" afterwards.

Travel advances are not possible when filing a Leave of Absence.

-

What is the salary schemes for University Staff according to the Collective Bargaining Agreement?

Academic university staff

According to the job group scheme for academic staff (referred to as ‘staff members in science / art’ in the Collective Bargaining Agreement), academic staff members are allocated to the job groups A1, A2, B1, B2 and C.

The data refers in principle to an employment 40 hours per week (gross salary).- Job group A 1 – university professors appointed on the basis of an appointment procedure (section 98 and section 99 of the 2002 Universities Act)

- Job group A 2 – academic staff with whom a qualification agreement was concluded

- Job group B 1 – university assistants (referred to as ‘assistant professors’ in the Collective Bargaining Agreement), senior scientists, senior lecturers and project staff who have completed a master’s or diploma programme

- Job group B 2 – lecturers

- Job group C – student staff and project staff who have not completed a master’s or diploma programme

General university staff

According to the Collective Bargaining Agreement for University Staff, all staff members are allocated to job groups I to V depending on fulfilment of classification criteria. Every job group comprises two qualification levels, to which the staff members are allocated: the basic level and the regular level.

The basic level applies to- staff members who are employed in the relevant occupation for the first time (in particular high school or university graduates),

- staff members with no previous job-specific experience, or

- staff members who have been reallocated from lower job groups.

The regular level applies to staff members after three years at the basic level of the same job group.

An advancement to regular level is possible earlier than after three years- if proof of previous job-specific experience is provided, or

- if the staff member has been reallocated from a lower job group and would have to be allocated to the basic level of the higher job group as laid down in article 53, para. 2 and already possesses the required knowledge and experience, or

- if s/he has successfully completed subject-specific internal and external measures of continuing education and training to improve or expand his/her skills.

Please click on the link to see the current numbers.

Gehaltsschema des Kollektivvertrags Wissenschaftliches Universitätspersonal Allgemeines Universitätspersonal

-

Where can I find help with the online forms?

Here's some ➥quick guides with pictures for the online forms:

- Travel request

- Travel accounting (allowances and approved travel request)

- Reimbursement of travel costs (no allowances)

- Reimbursement of material costs/online conference fees

If you have any further questions, please contact Michael Dorninger.

-

Which form should I use for reimbursements of material costs and online conference fees?

Please go to HR&FI services and use the app „Reimbursements“.

-

Should I take a train or a plane?

This is still up to you. However, if your project has overheads, 20% of a flight’s price (min. € 50, max. € 150 ) will be deducted additionally by the overheads as a climate compensation. Please refer to the university's Nachhaltigkeitsrichtlinie.

In FWF projects, voluntary compensations can be reimbursed up to 15% of a flight's price.

If you decide to take a train, hotel stays on longer voyages can be reimbursed, as well as tickets for couchettes or sleeping cars.

The Austrian Klimaticket itself is unfortunately non-refundable. Instead, transportation allowance or the surcharge to a 1st class ticket can be reimbursed

-

Is my hotel, insurance etc. taxable or non-taxable?

In most cases hotels, etc are non-taxable. Invoices only have to be taxed if the employee gained a private advantage from a work trip. (E.g. a travel insurance for a whole year that can be used for private trips.)

You can always ask Michael if you're not sure!

-

What are the daily and overnight allowances?

-

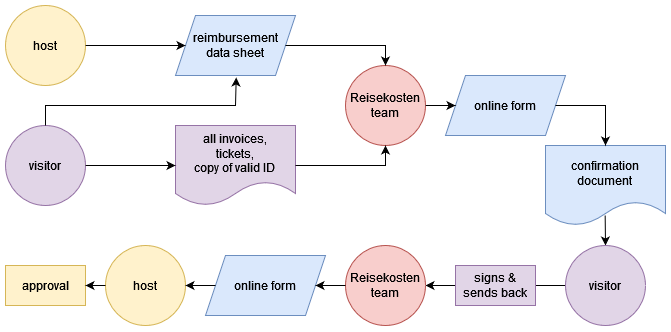

How can I refund a guest‘s travel expenses?

In most projects, guests can be reimbursed for receipts/invoices only. Taxi costs are usually non-refundable, neither is food.

Please use the Faculty’s ➥reimbursement data sheet and send it digitally filled to Michael Dorninger or to reisekosten.mathematik@univie.ac.at.

On the sheet, you find further instructions and info on which documents to attach.

You can find detailed instructions in German also in ➥[u:wiki].

-

How can I refund my travel expenses?

Reimbursements are done online via the HR&FI services. Under „Invoices, Travel & Financial Reports“ choose either „Reimbursements“ or „Travel Accounting“.

- only receipts (no food in FWF projects)

- requested documents: receipts/invoices, train tickets – booking confirmations do not suffice!

- also possible without travel request

- possible until the end of next calendar year

- receipts and allowances (per diems, kilometre allowance for car and train)

- requested documents: receipts/invoices, tickets, boarding passes, payment confirmations – booking confirmations do not suffice!

- travel request needed

- when an advance payment has been requested or a taxable receipt shall be reimbursed

- possible until 6 months after the trip (or the end of employment if that's sooner) - note that the month you're travelling in already counts as month #1!

-

How to calculate the personnel costs of my project?

Please go to our webpage ➥ COST CONTROL to find several cost calculation tools.

projektSERVICE can give you a projection of your planned personnel costs

finanzen personalkosten personal kosten berechnung planung

-

Are there any guidelines for the administration of my project?

Please become familiar with the administration of your project by reading following guidelines:

- for §27 projects (including new FWF-projects):

Starting §27 Projects - for §26 projects (old FWF-projects):

Starting §26 Projects

beginn budget finanzen

- for §27 projects (including new FWF-projects):

-

What is the form "Überweisungsanforderung" in FWF projects?

In your documents from FWF (only "old" §26 projects) you will find a form called "Überweisungsanforderung". With this form you can request money for non-personnel costs from FWF. Please use this form before non-personnel costs arise. The requested amount should last for about six months.

This form can be sent as a scan to FWF.

sachmittelkonto reisekosten minus sachmittelkosten sachmittel kosten

-

How can I have my expenses refunded from my project funds?

Reimbursements of receipts and online conferences are done via the app "Reimbursements" in ➥HR4U.

refundierungen konferenzkosten reisekosten ausgaben reiseantrag rechnungen

-

What should I do when I want to invite a guest?

Before arrival of the guest please fill out the ➥VISITOR-FORM. An office request and a hotel reservation request can be placed there.

After the visit Michael Dorninger [office 10.140] can help you with reimbursement of the costs from your project account.

For this, please send the ➥reimbursement data sheet with all attachments either to him or directly to reisekosten.mathematik@univie.ac.at.

You can find detailed instructions in German also in ➥[u:wiki].

gast gäste einladung büro hotelreservierungen besuchen

-

What is the gross/net salary of standard FWF-funded personnel?

For the Standard personnel costs and gross salaries for FWF project proposals please visit the following web-page:

https://www.fwf.ac.at/en/research-funding/personnel-costs/For calculating the net salaries please use this tool:

http://onlinerechner.haude.at/bmf/brutto-netto-rechner.html

brutto netto lohn gehalt personalkosten netto gehalt

-

Will the FWF refund a social dinner during an event?

Yes, this is possible, under two conditions:

- The dinner may not take place on the last day of the event.

- No alcoholic drinks can be funded.

arbeitsessen conference dinner veranstaltung

-

What is the deadline for annual or final reports to FWF?

Please check your contract!

Usually it is

- three months after the end of the project for the final report;

- end of March for annual reports.

jahresbericht endbericht jahres-bericht end-bericht

-

What is the overhead policy of the university?

Please find here the new regulation:

overhead kosten overhead regelung overheads

-

How can I see the detailed costs and the personnel costs of my project?

Both - the personnel and the non-personnel cost - can be seen in the SAP.

If you don't have installed this software please contact projektSERVICE to get an export of your SAP-account.

personalkosten sachmittelkosten budget

-

How do I get an overview of the (un-)used funds of my FWF-project?

Please follow the the guide "(un-)used project funds [FWF]" in [PROJECT].

verfügbare Projektmittel unverbraucht available unused Projektübersicht Rest verfügbare mittel

-

Does the lump sum of €15.000 expire in my ESPRIT-project after the first year?

In the guidelines one can read:

"In addition to the principal investigator's salary, a lump sum of €15,000 per year is approved to cover further project-specific costs"

This doesn't mean that the unused funds of the €15.000 expire at the end of the first year. You have the amount (in addition to the €15.000 of the second and respectively third year) available for the entire duration of the project.

sachmittel